The net metering scheme remains in the Netherlands

The phase-out of the "Salderingsregeling" incentive scheme is off the table, which is good news for solar panel owners in the Netherlands. Households and small businesses can continue to fully benefit from this scheme. Panels are competitively priced, installers can install in the short term, allowing you to fully utilize the 2024 solar season. As a small user, you still have the opportunity to maximize the benefits of the net metering scheme and the feed-in tariff. In short, if you are considering purchasing solar panels, now is the time.

For small users considering switching to solar panels, we have summarized the various terms and incentives.

Net metering scheme

Through the net metering scheme, households and small businesses can offset self-produced electricity that they are not using at that moment and return it to the electricity grid against their own consumption. This results in a tax benefit. For example, if you generate a total of 3,000 kWh and use a total of 5,000 kWh, you ultimately only pay for the remaining 2,000 kWh. You don't have to pay taxes on the 'offset' 3,000 kWh of electricity.

Feed-in tariff

Feeding in means that you send back to the grid the energy generated by your solar panels that you do not use or store yourself. Suppose you have generated 5,800 kWh, but only consumed 5,000 kWh. Then you feed the remaining 800 kWh back to your energy supplier and receive a feed-in tariff for that. You can return your surplus generated energy to the grid and receive compensation from the energy supplier. Until 2027, this is at least 80% of the supply rate agreed upon between the owner of the solar panels and the energy supplier, excluding taxes and levies. From 2027 onwards, the minister determines every 2 years the compensation that energy suppliers must give their customers at a minimum for electricity that they cannot offset.

VAT on solar panels

Until January 1, 2023, you were technically considered a small business by the Tax Authority because you supplied electricity to your energy company. But from that date, VAT on solar panels has been abolished, and the current VAT rate is now 0 percent. This specifically applies to solar panels on or near homes.

Payback period

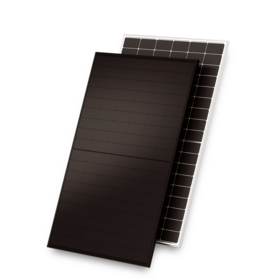

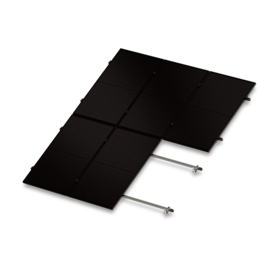

For an average installation of 10 solar panels, the payback period for a household is less than 6 years and in many cases even less than 5 years. This corresponds to an average return of more than 6% on your investment. Additionally, a roof with 10 solar panels contributes to a more sustainable climate, with annual CO2 savings of 1,000 kilograms in emissions. This is equivalent to the growth of an average of 40 trees.

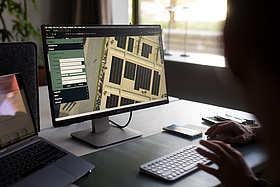

In conclusion, now is a suitable time to invest in solar panels. Contact an Autarco installer for a solar energy system that fully utilizes the potential of your roof.

Sources

Energiekamer - Terugleveren en salderen

Consumentenbond - Salderen en terugleververgoeding zonnepanelen Milieucentraal

Zonnestroom Nederland - Subsidies voor zakelijke zonnepanelen

Encon - CO2 calculatie