VAT rate 0% for residential end customers in the Netherlands, this changes for you

VAT rate to 0% for residential end customers, this changes for you

As you may know, from 1 January 2023, VAT on solar panels for residential end customers has been abolished. This makes you, the installer, the one who has to reclaim the VAT. This is why we have increased the credit limit by 21% for all of our Dutch customers.

As an installer, you pay 21% on the purchase price of the solar panels, but can pass on 0% VAT to the end customer. You will eventually get the VAT back from the Dutch tax authorities, which usually takes between 3 and 4 months. So the cash flow for an installer will be different: you will often still be entitled to a VAT refund.

Do you have more questions about this? Then check out the Dutch tax authorities' factsheet on this topic. Do you have a question about the change in your credit limit? If so, please contact your account manager.

When does the zero VAT rate apply?

The zero rate is only valid for residential systems. This includes systems on (holiday) houses, garages, sheds and gardens. However, you must be able to prove that the solar panels are placed on land for residential purposes. You can do this by taking a screenshot of the address in the BAG land register. Do you have a project for a commercial system such as making business premises more sustainable? Then VAT is still 21%.

Another condition for the zero rate is that the invoice date must be in 2023. Invoices from 2022 are still charged with 21% VAT, even if the installation takes place in 2023.

What about invoices?

So when the invoice was sent also determines the VAT rate. However, there is a condition attached to the invoice date. If no down payment was made, the invoice date must be no later than the 15th day of the month following the delivery and installation of the solar system.

Moreover, if a down payment does have to be made, there must first be an invoice for the down payment. That invoice must state at least the amount of the downpayment and VAT.

What will change for you as a dealer?

To ensure that you as installer grow with us, it has been decided that we will increase the credit limit for all our Dutch customers by 21%. You can ask your account manager exactly how much that will be. Furthermore, you can use the following tips to keep your cash flow stable:

- Ask for a higher down payment from the end customer, e.g. from 20% to 35%;

- Ask for a VAT refund from the tax office every month;

- You can read other tips in this Solar Magazine article via this link;

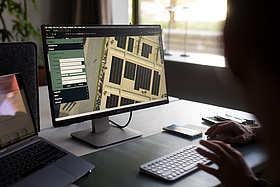

- In Helios, you can set the VAT to 0%, allowing you to offer right price to your end customer.

Why is there zero VAT on solar panels for residential end customers?

The VAT rate has been changed because it was unclear to many consumers how to reclaim the VAT on their solar system. As a result, the Dutch tax authorities were too busy arranging refunds. An additional advantage of the abolition of VAT is that solar is now relatively cheaper, making it more attractive for end customers to opt for solar.